SmartSearch

An Indicator of College Admission and Affordability

An Indicator of College Admission and Affordability

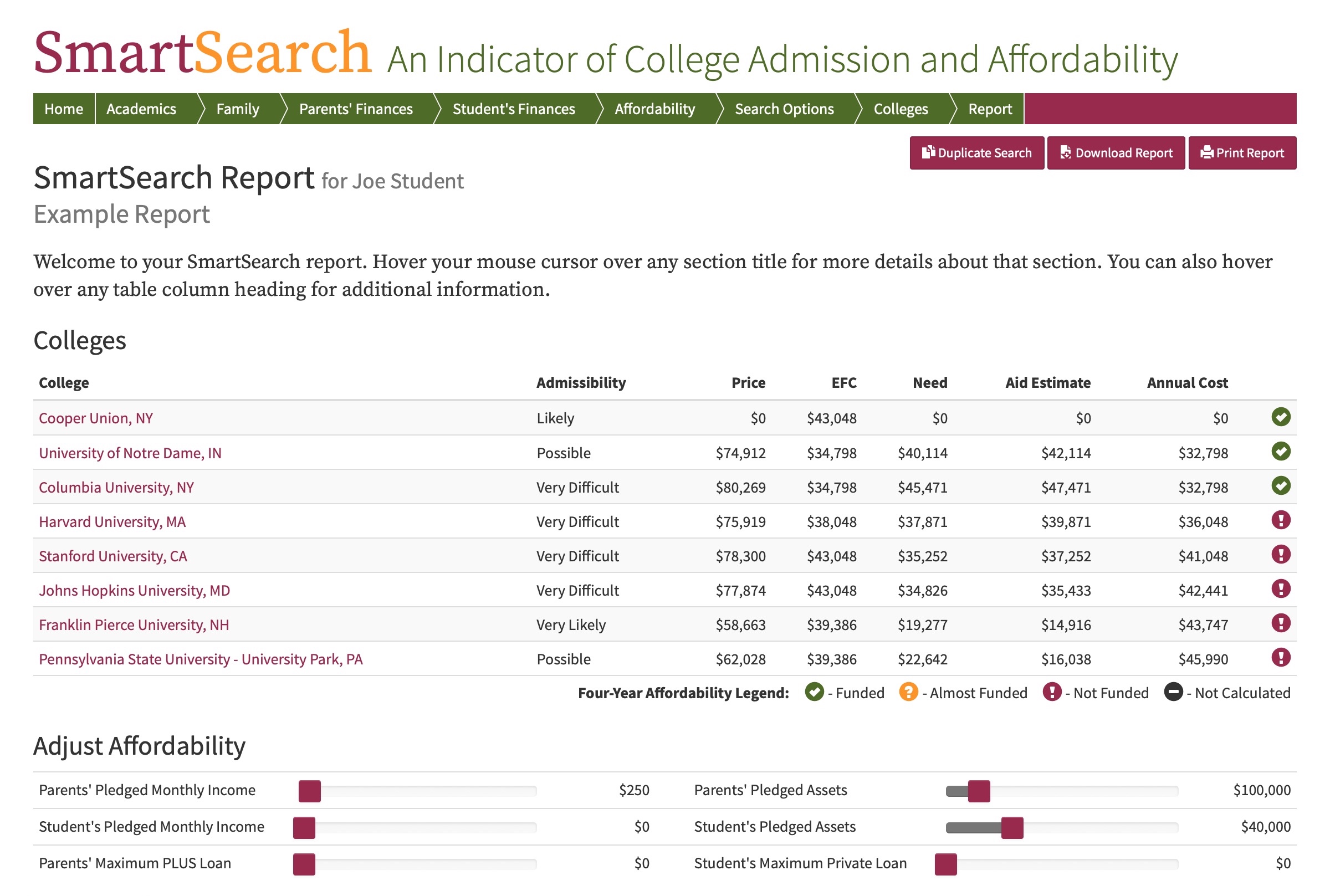

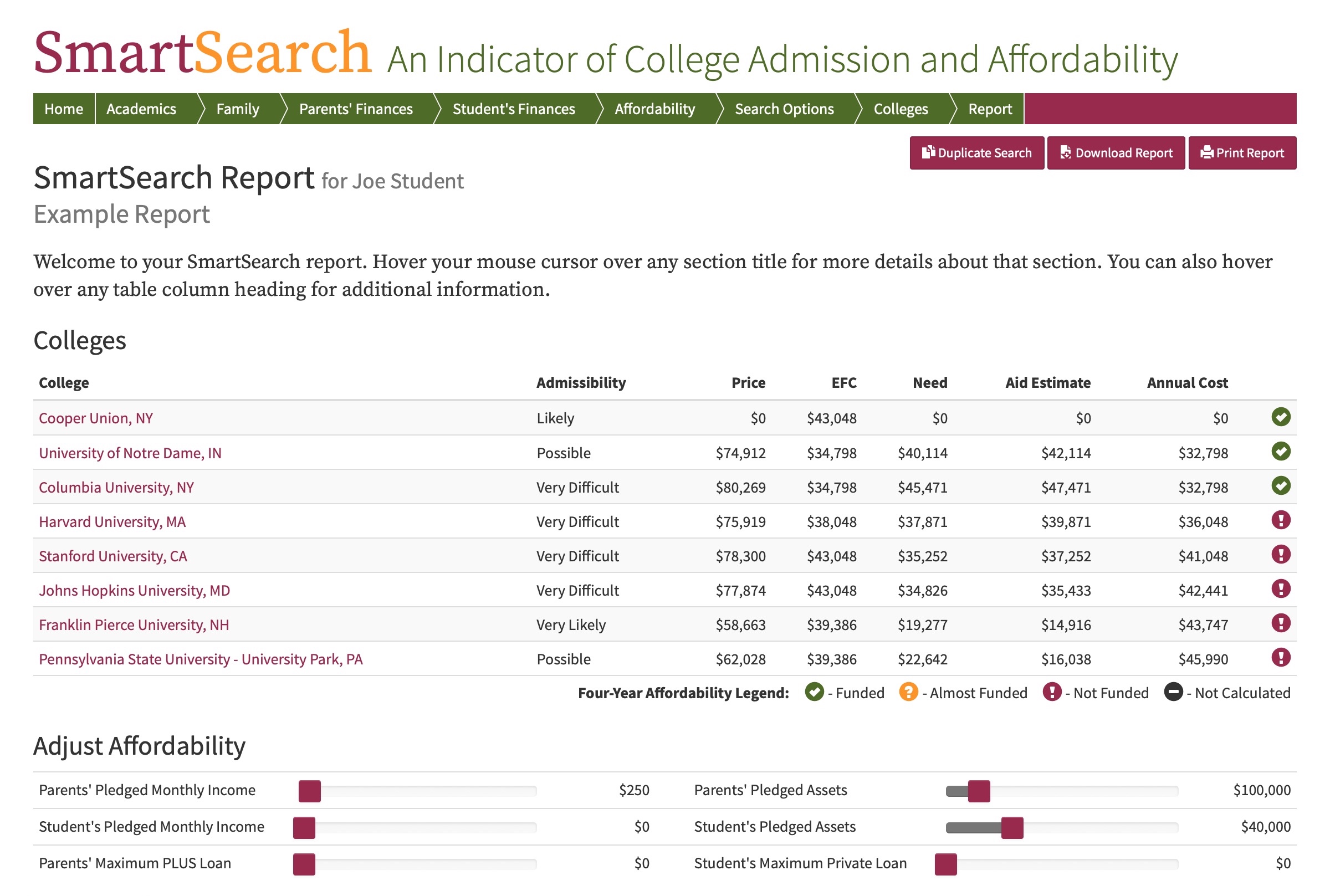

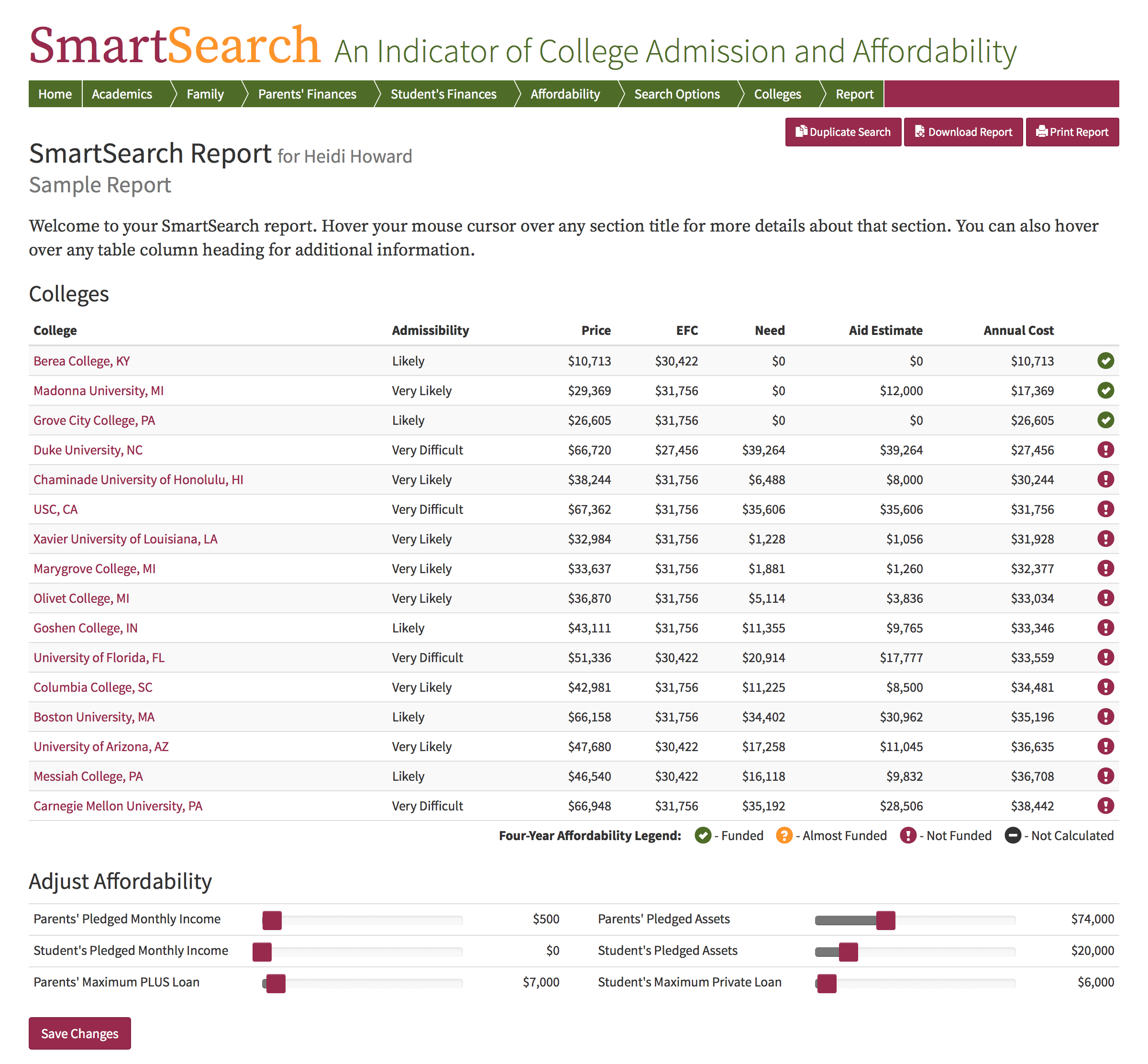

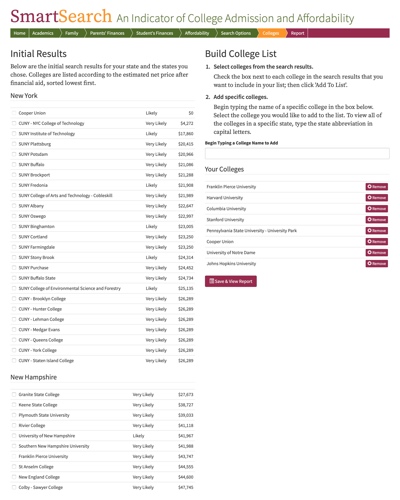

Find colleges where you are likely to be admitted.

See estimated Financial Aid at each college you are interested in.

Calculate how much each college would cost you whether you have the resources.

College planning is complicated and stressful for families.

The cost for your client’s child to attend the best colleges in America today exceeds $270,000 per child over four years (over $400,000 after tax). This huge cost must be paid over 4-8 years, and what your clients spend on college they won’t have for retirement. As college approaches, pressure and uncertainty begin to mount, so parents start looking for direction and answers and a solution – regardless of their income level, assets or advisors.

Position yourself to provide the answers your clients need.

Fortunately for you, only a tiny percentage of the best financial advisors in America have educated themselves on how to advise clients on their best strategy to pay for college and preserve assets and income for retirement. Meanwhile, parents send their children to college regardless of economic conditions. And they keep sending them year-after-year.

Costs have risen, pressure keeps mounting and families keep coming. They need their financial advisor to confidently and strategically provide a solution to paying for college.

Simplify finding the best strategy to pay for college for your clients.

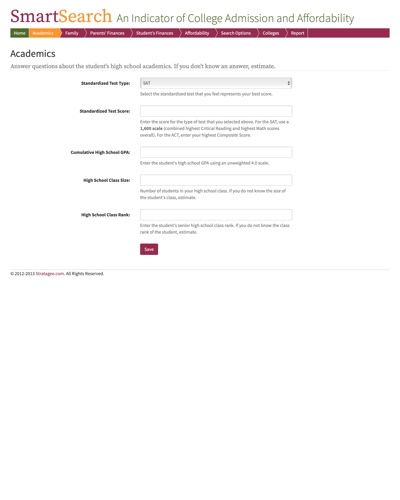

Determining a client’s best strategy to pay for college requires expertise in college admissions, financial aid, tax strategies, financial planning and investment management. Knowing how to bring expertise together in all of these areas and arrive at a client’s best strategy is very complex and requires a rare skill set.

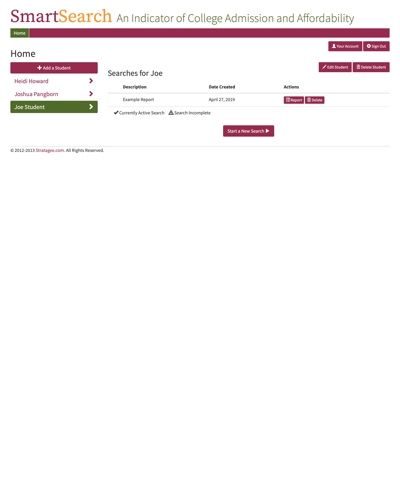

SmartSearch brings together all of this expertise into one easy to use web-based application.

Provide your client's with expert college planning advice.

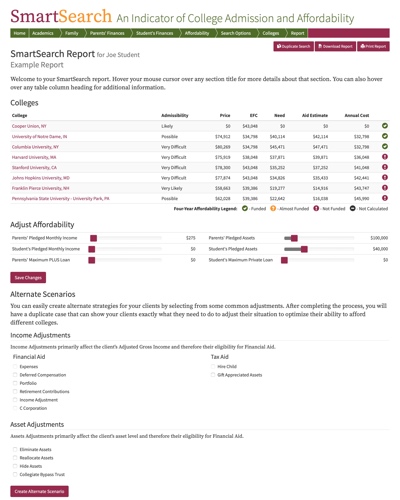

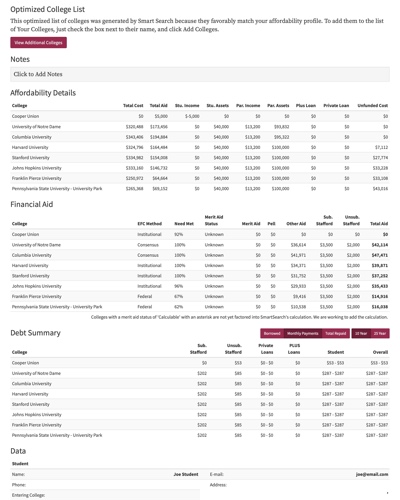

Licensing SmartSearch is like having your own in-house team of college planning experts. You get access to unique software that is centered on a consultative financial planning approach to determine a client’s best strategy to pay for college and preserve assets for retirement. SmartSearch simplifies this complex process and communicates it to the client with actionable steps – instilling confidence that they are making the best use of their resources and aren’t leaving money on the table.

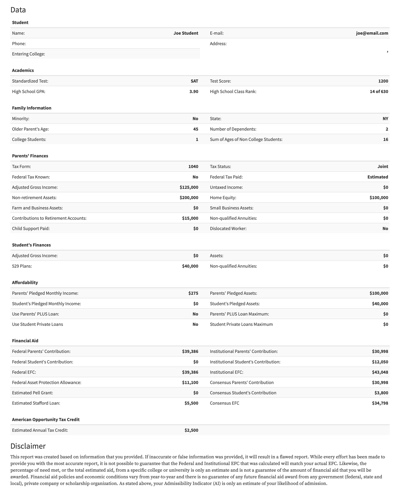

Download and review a sample SmartSearch report and see the depth and clarity included.

DownloadTroy [Onink]’s advice [compiled with SmartSearch] has meant thousands in savings each year. Even as our situation has changed we’ve known exactly what to do to qualify for the most aid, save on taxes and pay for college without sacrificing our retirement savings.

Daughters at Duke University and Brown University.

Mining data that is publicly available, SmartSearch analyzes it via a unique algorithm to provide results that are the best I’ve seen to help families, with professional guidance from counselors and financial planners, make well-informed application and enrollment decisions.

Forbes Contributor and Senior Associate Director of Admissions at Drew University

We don't offer trial periods at this time, but would be happy to schedule a live web-based demo. Just contact us to schedule a time.

We accept all major credit cards and ApplePay.

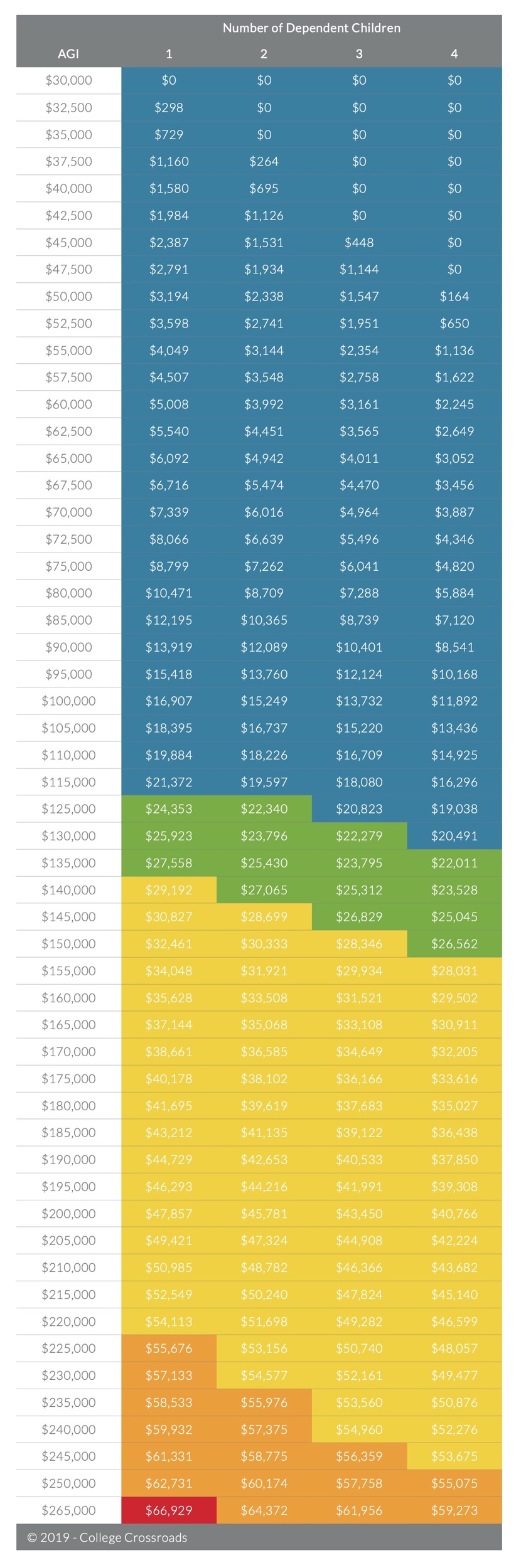

Download our free 2019-2020 EFC Quick Reference to get an at-a-glance estimate of your EFC and at what types of college you might qualify for need-based financial aid.

Download